Four ways to organise your budget with YNAB

After trying a lot of different ways on how to organise my budget (with YNAB) I want to share some of them with you.

What is YNAB?

In case you never have heard of YNAB, let me tell you: it is an awesome app for budgeting.

"But budgeting is boring!" you might say. To be honest, I was thinking the same in my younger years!

After using YNAB now for multiple years, I can tell you: Budgeting is neither boring nor a hassle.

Why is this? Well, YNAB is using four simple rules to get you started with budgeting:

- Give every Dollar a Job

- Embrace your true Expenses

- Roll with the Punches

- Age your Money

That does not sound like much, but behind the scene there is a lot going on with those four rules.

So if you are new to budgeting or if you want to try something new, try YNAB and come back afterwards: Try YNAB Free For 34 Days

Now let's get started with some ways I tried out of organising my budget.

Way #1: The Default

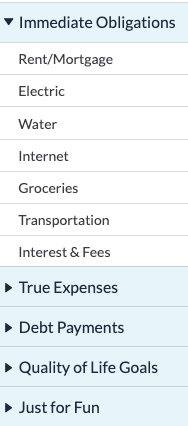

When you set up a new budget, you will end up with a default structure for categories. This default structure already includes a good starting point for budgeting! (Also these default categories might change in the future).

The categories are split into the following main categories:

-

Immediate Obligations

Basically the stuff you need to live including rent/mortgage, groceries and more -

True Expenses

Stuff that is not that essential but still happening once in a while (christmas gifts, medical treatment and so on) -

Debt Payments

All the loans -

Quality of Life Goals

Vacation, Fitness and Education. So stuff to be fit in terms of body and mind as well as soothed (vacations!) -

Just for Fun

Includes categories for things that might not be essential in life like "Gaming" (if you are not a professional gamer, that is)

This is a good starting point and can definitely stick to it, if you want to.

I would recommend to start with that and individualise based on your needs.

Way #2: The Minimalist

After some time I tried to go with a real minimalistic approach based on the 50/20/30 sub categories:

-

Everything

This main category is including everything. Its sub categories are as follows:- Needs

- Wants

- Savings

This approach is definitely easy to set up and maintain. Budgeting and adding transaction is a matter of seconds rather than minutes! Paying rent -> Needs, buying a game on steam -> Wants.

But it comes at the cost of less specificity. Here you will have your issues with optimising your expenses mostly because it is not that easy to see how much money you spent for groceries for example.

Way #3: The Frankenstein

More or less the complete opposite of the minimalist way. I created such a "monstrosity" to be super specific about my expenses and planning for them.

And hey, at least with this approach I see that I have spent around 50$ on steam in some months.

Because all categories and sub categories would be way too long to display, I will provide only an excerpt of one main category with some of its sub categories:

Vacation- Flights

- Food

- Hotels/Stays

- Souvenirs

- Sightseeing

- Transaction Fees

- Transportation

If you are into super specific budgeting, this approach may be for you. But so many categories have a major drawback because you will have to split expenses like groceries every time! So detailed planning and budgeting is nice, using like 5 minutes for adding a transaction of groceries probably isn't that much fun.

Way #4: The 50/30/20

The minimalist approach is the minimalistic version of this approach. The biggest difference is that the sub categories from the minimalistic way are now main categories and include a bit more specific sub categories.

The whole idea behind the 50/20/30 rule is to split the essentials/needs, the wants and the saving from each other by percentage. Together it is 100% after tax of your money (so for swiss people: deduct your tax first!).

50 percent of your after tax income is assigned to your life essentials, basically food, some roof over your head, other necessities.

The next twenty percent is for the "wants". Like going to Cuba for vacation, going out on friday evening or buying a new car.

The most difficult part here is the differentiation between needs and wants. If you are a freelance developer then a laptop is more of a need than a want. Most often stuff is sneaking into the needs, so have a close look at those!

The last 20% are for your saving. You never know what the future brings, so those savings are a cushion for bad things (like a job loss) as well as for bigger goals in life (your own house, a longer time off your work, retirement).

Bonus #5: My current

After the previous four, here comes my current budget categories (which probably will change again in the near future).

-

Health

- Medical Treatment

- Medical Insurance

- Sport

-

Life

- Lunch @ Work

- Coiffeur

- Freetime

- Mobile Subscription

- Clothes

- Spotify

- Other

-

Mobility

- Car Maintenance

- Car Insurance

- Gas

- Transportation

- Parking

- Road Tax

-

Savings

- Third pillar (Retirement)

- Aquisitions

- Education

- Future kid

- Vacations

- New car & trailer

- Emergencies

- Tax

- YNAB

-

Living

- Household Help

- Groceries

- Household Insurance

- Internet

- Rent

- Utilities

- Radio & Television Fee

I did not take a picture because my categories are in german.

Conclusion

Organising your budget is a personal thing. Some people have the urge to use as less categories as possible, others want super detailed budget and tracking. For me I'm currently somewhere in between.

Might be you use a similar structure or maybe something completely different? Hit me up, would love to know how you organise your budget!